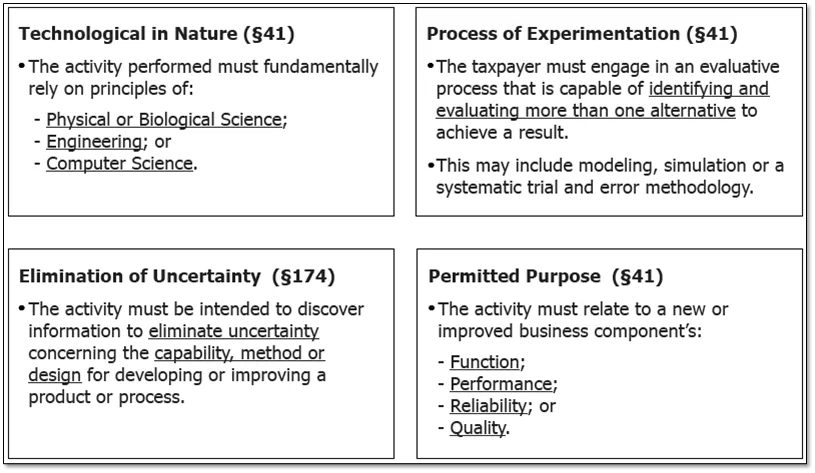

The four-part test is a bit arcane. The rest of this post drills down to explain each part of the test and offers examples of key points to give you a clearer idea at a basic level whether you meet R&D tax credit requirements. There are complexities and nuances that make it important to consult an expert in the field before implementing a claim, but this will give you a good start.

Technological in Nature

This part of the test seems fairly simple. However, it’s important to know that the three technological areas – physical or biological science, engineering, or computer science — can cross industries. Certainly, biological science is used in life sciences – like pharma and medical devices. It could also be used in food science and bio-flavoring.

Physical science, the study of non-living things and systems, includes chemistry, geology, astronomy, physics, oceanography and meteorology.

All facets of engineering can apply whether in aeronautics, chemicals, structural engineering and architecture, automotive – even toy companies that engineer products to work properly and use materials science to select the best resins to use in finishes and printed circuit boards for robotic toys, remote-controlled toys, etc.

Computer science is not limited to Silicon Valley software tech companies. It can be used by a bank developing an online banking app, an investment firm developing online trading and brokerage services – almost any hardware or software solution for any industry.

There are three types of software:

- Third-party sale, lease or license software – software developed for sale like Windows or a subscription-based SaaS service.

- Internal use software – software that a company develops to improve or monitor its own processes or operations.

- Dual-use software – software developed for internal use that can also be marketed in a vertical industry.

Elimination of Uncertainty

What technical hurdles or technical uncertainties were anticipated with respect to the R&D undertaken upon the onset of the research? What were the anticipated challenges or difficulties inherent with the R&D processes?

Permitted Purpose

The activity for which you’re claiming R&D tax credit must hit at least one of the following areas related to products or processes:

- Function – This relates to best in class product rollouts and continuous improvement. A good example would be new automobile models with features that make them more fuel and energy efficient

- Performance – Continuing with the automotive example, this could be better gas mileage.

- Reliability – This could be greater durability, more attrition resilience of its components (e.g., more durable and reliable engine, more durable and reliable tires, etc.)

- Quality – Has the overall quality of the product increased year-over-year through experimentation?

To learn more about R&D tax credit requirements visit our R&D Tax Credit Services page or please feel free to reach out to the PMBA National R&D Tax Credit Practice at R&DTaxIncentives@pmbusinessadvisors.com.